WELCOME FORBES READERS

The Cash Account

Your money's new

high-yield home

3.30% APY

(provided by program banks)

on all your cash. No account fees. No min or max balance.

Terms and Conditions apply. See below for details.

Get an extra

0.65% APY

for 3 months on up to $150,000.

Up to $8M in FDIC insurance

eligibility through program banks. Conditions apply.

You have been directed to this page from Forbes (“Marketing Partner”). The views and opinions expressed by the Marketing Partner are their own, and Wealthfront Brokerage LLC (Wealthfront Brokerage) does not endorse, sponsor, or promote them.

The referring Marketing Partner receives cash compensation from Wealthfront Brokerage for sponsored advertising materials placed on their website or other contents, which creates an incentive that results in a material conflict of interest. The referring Marketing Partner earns $5-10 per click on the tracking link that drives traffic to the Marketing Partner's promotional landing page for Wealthfront.

The Marketing Partner is not a client and this is a paid endorsement. The referring Marketing Partner and Wealthfront Brokerage are not associated with one another and have no formal relationship outside of this arrangement. Disclosures continued.

*The Base APY is 3.30% as of 1/30/26, but is variable and is subject to change. If you are eligible for the overall boosted rate of 3.95% offered in connection with this time-limited boost promotion (the “Promotion”), your boosted rate is also subject to change if the base rate decreases during the three-month promotional boost period.

The Cash Account is offered by Wealthfront Brokerage LLC ("Wealthfront Brokerage"), Member FINRA/SIPC. Wealthfront Brokerage is not a bank. The Cash Account is not a checking or savings account. The Annual Percentage Yield ("APY") on cash deposits as of January 30, 2026, is representative, requires no minimum balance, and may change at any time. The APY reflects the weighted average of deposit balances at participating Program Banks, which are not allocated equally. Funds in the Cash Account are swept to Program Banks where they earn a variable APY and are eligible for FDIC insurance. Conditions apply. Click here for a list of Program Banks. While funds are at Wealthfront Brokerage or in transit, they are not FDIC-insured but are eligible for SIPC protection up to $250,000 for cash. FDIC insurance is limited to $250,000 per customer, per bank, regardless of whether those deposits are placed through Wealthfront Brokerage. You are responsible for monitoring your total deposits at each Program Bank to stay within FDIC limits. Wealthfront works with multiple Program Banks to make available up to $8 million ($16 million for joint accounts) of pass-through FDIC coverage. For more info on FDIC insurance coverage, visit www.FDIC.gov.

Beginning on October 21, 2025, this Promotion will be available to prospective first-time Wealthfront clients (i.e., persons who are eligible to open a Wealthfront account and have never opened or held one before) (each an “Eligible New Client”) who open and fund a personal Cash Account with Wealthfront Brokerage (each a “Cash Account”) while this Promotion is in effect and available (the “Promotion Period”), such Promotion Period to be determined by Wealthfront Brokerage in its sole discretion. During the Promotion Period, once an Eligible New Client opens and funds a Cash Account as their first account, they may be eligible to receive a 0.65% annual percentage yield (“APY”) increase over the then-applicable standard APY (a “Promotional Boost”) on the balance in their respective Cash Accounts for three (3) months on up to a maximum aggregate balance of $150,000 across their Cash Accounts (the “Maximum Balance”), provided the applicable requirements set forth below are satisfied.

To earn this Promotional Boost, an Eligible New Client must: (1) click on either the “Get Started” or “Start Earning” button on this promotional landing page to begin the account application process; (2) successfully open open a new Cash Account while this Promotion is in effect (and this promotional landing page is still active); and (3) fund the Cash Account during the Promotion Period.

The Eligible New Client will begin receiving the Promotional Boost on their Cash Account balance (up to the Maximum Balance) and interest will start accruing within 24 hours after their Cash Account has been funded, and the Eligible New Client will continue to receive the Promotional Boost for three (3) months from that date (the “ Boost Period”). If an Eligible New Client closes their Cash Account during the Boost Period, their Boost Period will continue to run and will not be extended. See further information.

Only one Promotional Boost can be applied to increase your APY at any one time. Any additional promotional boosts you earn outside of this Promotion may be applied one at a time following the end of each applicable Boost Period (i.e., if you earn multiple promotional boosts, your APY will not be increased by more than 0.65% over the standard APY, but one or more additional boost periods may be added to follow your initial Boost Period), subject to the applicable terms and conditions. Persons who qualify for a Promotional Boost through this Promotion as a result of opening accounts are not eligible for any other account opening promotions offered by Wealthfront Brokerage outside this Promotion, except to the extent permitted by the terms and conditions of the other promotion. Wealthfront Brokerage reserves the right to impose a reasonable cap on the value any one person is eligible to receive through participation in promotions offered by Wealthfront Brokerage or any of its affiliates for any period of time, in its sole discretion, with or without advance notice, to be determined solely by Wealthfront Brokerage. Boost Periods cannot be postponed or extended. If you close a Cash Account earning a Promotional Boost prior to the end of your Boost Period, you will forfeit the remaining portion of your applicable Promotional Boost.

Wealthfront Brokerage reserves the right to modify or terminate the Promotion, in whole or in part, at any time without notice. Wealthfront Brokerage has no obligation to open an account for any particular person, regardless of that person’s participation in any promotional program, and may accept or reject applications in their sole discretion. All eligibility decisions shall be made by Wealthfront Brokerage in its sole discretion. Without limiting the foregoing, Wealthfront Brokerage shall have sole discretion to determine whether any person qualifies for a Promotional Boost (including, but not limited to, whether all applicable requirements have been met) and to disqualify any person from receiving any Promotional Boost or otherwise participating in the Promotion for any reason, including (but not limited to) if Wealthfront Brokerage determines, in their sole discretion, that fraudulent activity or a violation of the terms of the Promotion may have occurred. In the event Wealthfront Brokerage disqualifies a Promotional Boost after interest has begun to accrue, Wealthfront Brokerage reserves the right to recapture the amount of interest attributable to the Promotional Boost previously credited to the maximum extent permitted by law. All federal, state, and local taxes and any related fees and expenses are the sole responsibility of the Eligible New Client. See additional terms.

1.3M+

$90B+

4.8

4.9

In total assets1

Trusted clients1

Apple App Store2

Google Play Store2

Best Cash Management Account, 2023-253

Savings? Checking?

Better.

Earn

8x

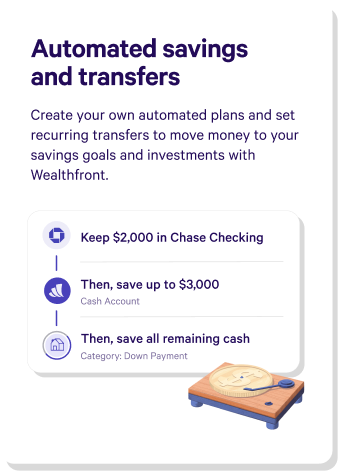

Who says you should have to choose one or the other? Wealthfront isn’t a bank, but we work with program banks to get you an industry-leading Annual Percentage Yield (APY), access to up to $8M in FDIC insurance eligibility, and an array of fee-free, no-strings-attached checking features — all wrapped up into one label-defying package we call a Cash Account.

more than the average

savings account

⁴

CHECKING FEATURES

SAVING FEATURES

Ready to get your money earning?

SID V. | CLIENT SINCE 2015

“The Wealthfront Cash Account is my main source of money coming in and going out. I just like the convenience of having everything in one place versus a whole bunch of services that I need to manage.”

NITIN K. | CLIENT SINCE 2015

“They always have me as a client, as a customer and a consumer with my best interests in mind... I have real time access to my money, even on weekends and holidays, which is a

remarkable feature.”

The testimonials above are by clients of Wealthfront Brokerage. No compensation was provided. These testimonials may not be representative of other clients’ experience and outcomes will vary. Rate is subject to change.

Your boosted rate

Will the interest rate lock in, or does it change?

questions, answered:

Short answer: It changes based on a number of factors—the most important factor being the Federal Funds Rate.

Long answer: It’s in our best interest to offer our clients a competitive rate, so we’re always looking for opportunities to do just that. When our program banks pay us more for your deposits, we pay it forward to you with a better APY. We’ll always notify you when the rate changes.

What happens if the base rate changes during my boost period?

It’s this attention to detail that we love about you. Your boost earns you an additional 0.65% APY on top of the current base rate your money earns in the Cash Account. Since our base rate is subject to change, your rate can change with it, but your APY boost will remain steady at +0.65% above the base for the limited time it's active (typically 3 months).

Is there a limit to how much I can earn with my boosted rate?

You can earn 3.95% APY on all the uninvested money in your Cash Account— for any balance up to $150,000 for 3 months (that’s a maximum potential interest payment of over $485 per month).

Back to top

Review Wealthfront Brokerage LLC with FINRA’s BrokerCheck here.

1. References to “Total Client Assets” and "Clients" include clients with assets in products offered by both Wealthfront Advisers and Wealthfront Brokerage. Wealthfront Advisers and Wealthfront Brokerage are wholly owned subsidiaries of Wealthfront Corporation.

2. Apple App Store and Google Play Store ratings are based on user ratings that are subject to change and submitted according to the applicable terms of use maintained by the Apple App Store and the Google Play Store. The Apple App Store and the Google Play Store do not utilize questionnaires or surveys and are not designed or prepared to produce any predetermined result. Users may submit ratings and verbatim feedback based on their experience with the Wealthfront application, which rating and or verbatim feedback may or may not reflect that user’s experience with the investment advisory product or service provided by Wealthfront Advisers. Reported ratings are as of July 7, 2024 and based on all user ratings submitted from February 2014 (Apple) and December 2015 (Google) through July 2024. Ratings independently compiled by Apple, Inc., and Google, Inc., who receive compensation for hosting our app but not for collecting or compiling reported ratings.

3. Bankrate receives cash compensation for referring potential clients to Wealthfront Brokerage via advertisements placed on their website which creates a conflict of interest. While they receive compensation for referring potential clients, Bankrate’s opinions, statements, and rankings provided above represent independent endorsements by Bankrate, and their awards, which are not directly tied to such compensation, are determined by their editorial team. Wealthfront Brokerage and Bankrate are not associated with one another and have no formal relationship outside of this arrangement. Bankrate is not a client of Wealthfront Brokerage. The formula used for Best Cash Management Account takes into account the range of deposit products offered, fees, minimum balance requirements, availability of competitive APYs, the extent of ATM networks, and key digital banking features. Best Cash Management Account awards received January 10, 2023, December 12, 2023, and December 11, 2024. Wealthfront pays an annual license fee to use Bankrate’s awards in marketing materials. Learn more about their methodology and review process: https://www.bankrate.com/awards/2025/methodologies/.

4. The national average interest rate for savings accounts is 0.39% as posted on FDIC.gov, as of January 22, 2026.

The Cash Account is offered by Wealthfront Brokerage LLC ("Wealthfront Brokerage"), Member of FINRA/SIPC. Neither Wealthfront Brokerage nor any of its affiliates are a bank, and the Cash Account itself is not a deposit account. The Annual Percentage Yield (“APY”) on cash deposits as of January 30, 2026, is representative, requires no minimums, and may change at any time. The APY for the Wealthfront Cash Account represents the weighted average of the APY on the aggregate deposit balances of all clients at insured depository institutions that participate in our cash sweep program (the "Program Banks"). Wealthfront sweeps available cash balances to Program Banks where they earn a variable rate of interest and, subject to the satisfaction of certain conditions, are eligible for FDIC insurance. A list of current Program Banks can be found here: www.wealthfront.com/programbanks. Deposit balances are not allocated equally among the participating program banks. FDIC pass-through insurance is not provided until the funds arrive at the Program Banks, and protects against the failure of Program Banks, not Wealthfront. While cash balances are at Wealthfront Brokerage, and while they are transitioning to and/or from Wealthfront Brokerage to the Program Banks, they are not eligible for FDIC pass-through insurance, but are eligible for SIPC protection, subject to the limit of $250,000 for cash. FDIC insurance coverage is limited to $250,000 for the total amount of all deposits a customer holds in the same ownership capacity per banking institution, regardless of whether those deposits are placed through Wealthfront Brokerage, so you are responsible for monitoring your total deposits at each Program Bank to avoid exceeding FDIC limits. Wealthfront Brokerage partners with more than one Program Bank to make available up to $8 million (or up to $16 million for joint accounts) of FDIC pass-through coverage for your cash deposits. For more information on FDIC insurance coverage, please visit www.FDIC.gov. Customers are responsible for monitoring their total assets at each of the Program Banks to determine the extent of available FDIC insurance coverage in accordance with FDIC rules. The deposits at Program Banks are not covered by SIPC.

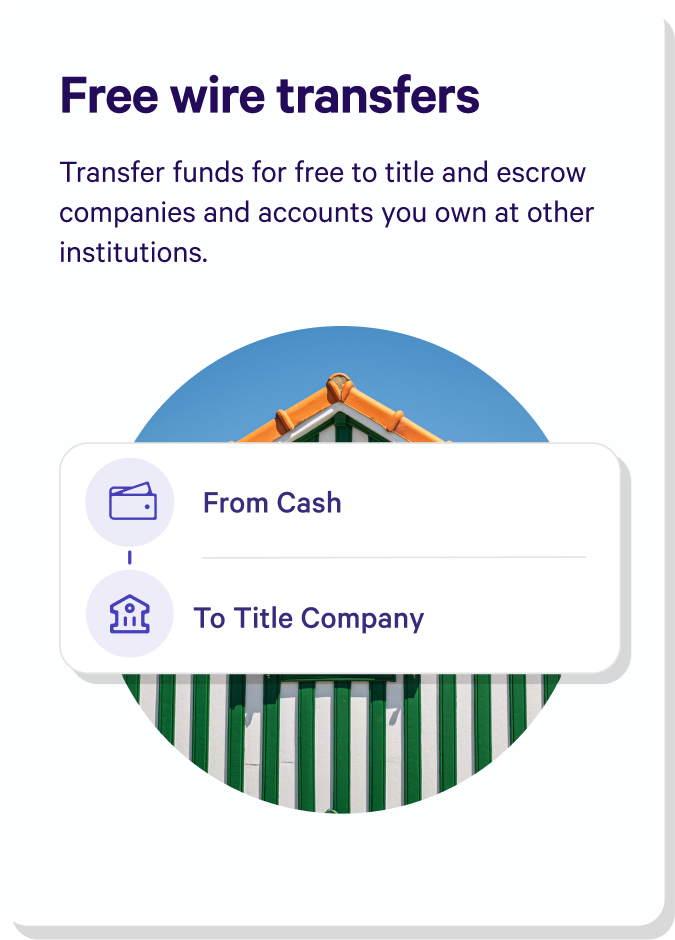

Wealthfront does not charge for wire fees to title and escrow companies and accounts you own at other institutions, but the receiving entity or institution may charge a fee. For more information about wires, visit www.wealthfront.com/legal/online-transfer-agreement.

Wealthfront Brokerage has partnered with Green Dot Bank to offer certain checking features including The Wealthfront Visa® Debit Card, send a check, and mobile check deposits to Wealthfront Cash Accounts. The Wealthfront Visa® Debit Card is issued by Green Dot Bank, Member FDIC, pursuant to a license from Visa USA. Inc. Visa is a registered trademark of Visa International Service Association. Green Dot Bank also offers certain Wealthfront Cash Accounts account & routing numbers which support additional checking features including bill pay, direct deposits, and payments through third-party sites. The checking features provided by Green Dot Bank for Wealthfront Cash Accounts are subject to identity verification by Green Dot Bank and the Wealthfront Visa® Debit Card is optional and must be requested. Green Dot Bank operates under the following registered trade names: GO2bank, GoBank and Bonneville Bank. All of these registered trade names are used by, and refer to, a single FDIC-insured bank, Green Dot Bank. Deposits under any of these trade names are deposits with Green Dot Bank and are aggregated for deposit insurance coverage. Wealthfront brokerage and advisory services are not affiliated with Green Dot Bank.

Wealthfront Brokerage has established a relationship with UMB Bank, National Association (“UMB Bank”), Member FDIC, which may allow certain Wealthfront Cash Accounts to opt-in to a limited-purpose account number and UMB Bank routing and transit number which will enable certain withdrawals and deposits into Wealthfront Cash Accounts including bill pay, direct deposits, and payments through third-party sites through the Automated Clearing House network. Wealthfront brokerage and advisory services are not affiliated with UMB Bank.

Fee-free ATM access is for in-network ATMs only. Out-of-network ATMs and bank tellers incur a $2.50 fee, plus any fee the owner or bank may charge. Fees and eligibility requirements may apply to certain checking features. See the Customer Debit Agreement at www.wealthfront.com/static/documents/client-agreements/green-dot-deposit-account-agreement.pdf for details. Copyright 2025 Green Dot Corporation. All rights reserved.

Wealthfront Brokerage Cash Account clients with an active Wealthfront Debit Card offered by Green Dot Bank are eligible for domestic out-of-network ATM fee reimbursement. Reimbursement covers fees on the first two withdrawals per card, per account, per month, including Green Dot’s $2.50 fee and up to $5.00 operator/owner fees (max $7.50 per transaction, $15 per month). Other fees are not reimbursed. No reimbursement is provided before September 16, 2024. Program may change or end without notice. See full terms at wealthfront.com/legal/out-of-network-terms.

Instant and same-day withdrawals use the Real-Time Payments (RTP) network or FedNow service. Transfers may be limited by your receiving institution, daily caps, or participating entities. New Cash Account deposits have a 2–4 day hold before transfer. Wealthfront does not charge fees for these services, but receiving institutions may impose an RTP or FedNow Fee. Processing times may vary.

The information contained in this communication is provided for general informational purposes only, and should not be construed as investment or tax advice. Nothing in this communication should be construed as tax advice, a solicitation or offer, or recommendation, to buy or sell any security. Any links provided to other server sites are offered as a matter of convenience and are not intended to imply that Wealthfront Advisers or its affiliates endorses, sponsors, promotes and/or is affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

By using this website, you understand the information being presented is provided for informational purposes only and agree to our Terms of Use and Privacy Policy. Wealthfront Advisers relies on information from various sources believed to be reliable, including clients and third parties, but cannot guarantee the accuracy and completeness of that information. Nothing in this communication should be construed as an offer, recommendation, or solicitation to buy or sell any security. Additionally, Wealthfront Advisers or its affiliates do not provide tax advice and investors are encouraged to consult with their personal tax advisors.

All investing involves risk, including the possible loss of money you invest, and past performance does not guarantee future performance. Please see our Full Disclosure for important details.

Investment management and advisory services are provided by Wealthfront Advisers LLC (“Wealthfront Advisers”), an SEC-registered investment adviser, and brokerage related products are provided by Wealthfront Brokerage LLC ("Wealthfront Brokerage"), a Member of FINRA/SIPC.

Wealthfront Advisers and Wealthfront Brokerage are wholly owned subsidiaries of Wealthfront Corporation.

© 2026 Wealthfront Corporation. All rights reserved.